You’ll find it difficult to land yourself the best loan if you completely ignore the interest rates attached to it. Without this understanding you won’t know what you’ll be paying back each time you make a repayment and likely find yourself going through somewhat of a financial shock.

In order to avoid this situation, you should continue to read articles such as this one until you know the ins and outs of interest rates and how they may apply to you.

What are interest rates?

Whenever you borrow money from a lender, you’ll normally pay extra to make it worthwhile for them. To put it in the simplest of terms, when you take out a loan, you’ll repay more than the total amount you receive from it.

However, it works the same for you too, so if you put money into a savings account, the bank you’re banking with will have to pay you interest which will build up over time. This means you get a bonus on top of the sum you’ve been able to save over time.

These payments are known as interest and it is usually charged annually; look out for interest rates before taking out a business loan of any kind. This will save you from being surprised by added on charges.

The rate of interest that is attached to a loan will differ from lender to lender, as will the extra fees you’ll need to pay back. Therefore, it is a good idea to compare the different interest rates on the market before signing up to a loan. Make sure you’re always on the lookout so you can get the best deal for yourself.

How are interest rates calculated?

To get a firmer grip on interest rates and improving your level of understanding we are going to run you through a quick and easy example. Remember, it is important that you’re aware of how much interest you’re going to either owe or receive.

A 5% yearly interest rate on a £2,000 loan or savings balance translates into an annual charge or return of £100. This can then be broken down monthly by dividing that £100 by 12 to give £8.33.

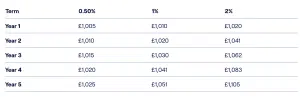

Of course, the numbers begin to get more complicated when you factor in the likes of compound interest, as this is added to previously earned interest. Having compound interest added on to your savings is great, as it effectively increases what you’ll be making year after year.

Although, you’ll need to understand that compound interest can be applied to loans also, meaning the opposite effect can happen. In this sort of situation, you’ll be paying interest on the total you originally borrowed, as well as on the interest accrued. This leads to quite the shock for many business owners, especially when payments are relatively small, and compounding is increasing daily.

This is once again why you must be careful and analyse all the finer details before agreeing to a business loan.

How are interest rates set?

The wide number of interest rates that are currently available can make things pretty confusing at times. Though, there are some substantial reasons behind this.

The financing costs high street banks set rely upon something other than just the Bank Rate. Interest rates for business loans, different elements are thought of, including the danger of the advance not being fully paid by the loanee: the more noteworthy the danger, the higher the rate the bank will charge.

There are also other factors that play into this which are worth making a note of:

The Bank of England base rate: Every central bank, the authority answerable for dealing with the cash and financial arrangement of a nation, sets a loan fee it charges high street banks. On account of the UK this is the Bank of England. Its base rate is intended to impact the ways of managing money of the populace and has a further impact on the amount we pay or acquire on loans and savings.

Costs: Finance businesses typically take the national bank’s financing cost and change it to cover their costs and create a benefit. Advances consistently convey a higher rate than investment funds and are regularly publicised at a yearly rate, itemising the all-out cost of acquiring – loan costs and charges – every year.

Risk: The more prominent the apparent danger that a credit will not get repaid, the more the loan specialist will charge. Elements contemplated incorporate the borrower’s credit rating, the length of the credit, regardless of whether it’s supported by guarantee and the requested total.

Demand: When banks are in need of cash, they may expand rates on saving records to urge savers to store cash with them. On the other hand, if interest for advances is low, they may diminish rates, to boost getting.

How do interest rates influence individual accounting records?

Loan costs impact the sum individuals spend or save and, in this way, have a major bearing on our levels of finance.

Borrowing

On the off chance that you wish to get cash, it’s essential to recall that the higher the loan fee, the more you’ll be charged generally.

How about we consider a £150,000 home loan to be paid off more than 25 years. With a 2.5% financing cost, you’ll reimburse £673 every month. Push it up to 3.5%, and abruptly your month-to-month cost develops to £751.

Financing cost rises can make it hard to spending plan, which is the reason numerous borrowers pick to secure a fixed rate. Dissimilar to variable loan fees, which banks have the attentiveness to change whenever, fixed rates ensure you’ll pay similar level of revenue until a concurred date of as long as 15 years. That is consoling yet in addition implies you could pass up setting aside cash if acquiring rates fall.

Savings

Savings accounts work in a contrary manner: if rates rise, your bank or building society should pay you more premium. It’s essential to think in “genuine” terms, however – if the publicised rate is 2% and inflation is running at 1.5%, your real return, in the wake of representing the expanded typical cost for basic items, is simply 0.5%.

Different focuses to consider incorporate how regularly premium is disseminated – the higher the recurrence of instalments, the more you procure from accumulating – and whether to pick a record offering a fixed pace of revenue, which may bid on the off chance that you don’t have to get to your reserve funds inside the predetermined time span and accept financing costs will fall around there

What is APR?

APR, or annual percentage rate, is a measure of the cost of borrowing money. It is expressed as a percentage of the amount borrowed and can be either fixed or variable. The APR includes not only the interest rate but also any fees that are charged by the lender. This makes it an important tool for comparing different loans and choosing the one that is best for you.

When considering a loan, be sure to ask about the APR and compare it to the interest rate. The APR will give you a better idea of the true cost of borrowing money.

How does compound interest work?

When it comes to personal finance, compound interest is often touted as a powerful tool for building wealth. But what exactly is compound interest, and how does it work? In simple terms, compound interest is interest that is earned not only on the original principal, but also on any previous interest that has been earned. To illustrate, let’s say you have £1,000 in a savings account that earns 5% compound interest annually.

At the end of the first year, you would have earned £50 in interest (5% of £1,000), for a total balance of£$1,050. At the end of the second year, you would have earned £52.50 in interest (5% of £1,050), for a total balance of £1,102.50. And so on. As you can see, the amount of interest earned grows exponentially over time.

This is why compound interest is often referred to as “the most powerful force in the universe.” While it may not be quite that dramatic, compound interest can certainly be a helpful tool for building wealth over the long term.

Tax on savings interest

As a UK tax payer, you may be surprised to learn that you are taxed on the interest you earn on your savings. Currently, the tax rate on savings is 20%, which means that if you earn £100 in interest, you will only receive £80 after tax has been deducted. While this may seem unfair, there are a few reasons why the government taxes savings interest.

Firstly, it is a relatively easy way to raise revenue. Secondly, it discourages people from keeping their money in savings accounts, as they will not receive the full amount of interest. Finally, it ensures that everyone pays some tax on their income, even if they do not earn enough to pay income tax. While the taxation of savings interest may seem unjust, there are some rationale behind it

Interest Rates Explained!

Lee Jones is a seasoned Business Finance Specialist with over two decades of invaluable experience in the financial sector. With a keen eye for market trends and a passion for helping businesses thrive, Lee has become a trusted advisor to countless organizations seeking to navigate the complexities of finance.