Get Instant Approval Online Now

No security or business plans required

Approval within 24 hours. 90% approval rate

Apply for a merchant cash advance in minutes

Flexible repayments based on your card sales

3 steps to help with the growth of your venture

An Alternative Funding Solution for SME’s in the UK

Access £5,000 – £200,000 in 24 hours

What is a Merchant Cash Advance?

A merchant cash advance is an unsecured short term lending finance option, it uses a card payment terminal to secure future borrowing. This type of funding is already proving very popular with UK SMEs as its fast and flexible and allows growth without the needs for security or debenture from the company. Any type of company that uses a merchant gateway to receive payment via a PDQ machine can apply to get finance with us.

The process will allow funding to be released against your future card sales. The amount of funds made available to you is mirrored with your average monthly card transactions. Repayments are set at a pre agreed percentage of each sale until the advance is paid off.

Typical repayment timescales for merchant cash advances are anything from 6 to 9 months, but dependent on your businesses history it can be can be as long as 18 months term. Once a positive repayment history has been demonstrated, usually about half way though the repayment process, you can apply to gain new funding. This will allow the amount that is borrowed and allow an extension of the term.

Unlike traditional bank funding options merchant cash advances have no interest rates set, just one simple repayment. One of the great aspects of this type of short term business funding option is there is no hidden fees, it is a perfect solution for businesses looking additional funding

Our business funding is a perfect alternative to high street business loans, it allows business owners to expand payment terms, helps with cash flow and help to grow your business, these are just a few of the benefits with a cash advance.

How does a Merchant Cash Advance Work?

A merchant cash advance works by using your future customer card payments to advance a single payment of cash to your business. This is then repaid back using a small percentage of your future card sales.

The percentage that you are asked to repay is agreed upfront so you have clear visibility of the schedule. A monthly merchant transactions turnover dictates the sum you will receive by way of the advance. As a minimum criteria should be constantly taking about £5,000 per month in card volumes to qualify in card revenue, you can find this on your merchant statements. If your business is achieving a good volume of credit card sales on a monthly basis, but has a cash flow need, our facility is a fantastic way of acquiring the extra funds your business to grow.

It works through an agreement set by the provider and the business, once the agreement is set the outlay of the merchant cash advance. In it will be such as the payback, advance amount, and holdback percentage will be discussed and an agreement between both parties will be made.

When the agreement is made, the advance is transferred to the business’ bank account in exchange for a future percentage of receivables or card receipts, these are your customer card transactions.

After the agreement has been made you business agreed on the percentage of revenue through credit card purchases are withheld according to agreed the percentage. The withheld percentage will pay back the sum that was initially borrowed. This practice will continue until the advance has been paid. Access to a business owner’s merchant account eliminates the collateral required for a traditional small business loan.

A fixed percentage is taken from every sale, meaning that the more payments made (transactions) the faster the advance is paid off. This rule also applies if the business has fewer transactions in a particularly slow term. The balance will still be getting paid but within less time. Meaning the business pays back the advance that is tailored directly to the business intake of merchant cash deposits

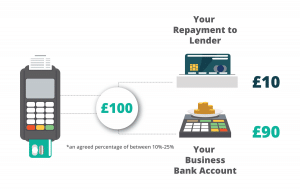

Here’s an example of a typical repayment:

In this example a small retail outlet processes £10,000 per month via their card terminal, this allows an advance of £10,000 to the retailer. The owner of the business pre agreed that 10% of their business card sales will be used towards the rsettlement of the loan with the merchant cash advance lender at the start of the arrangement.

The independent retail business turns over £10,000 on average every month in card sales, the owner is expected to repay £1,000 (10%) every month until the loan is fully repaid.

As there is no there is no set repayment term, it is predicted the business will repay the total advance amount of £12,000 in approximately twelve months. The payback period is flexible and may be shorter or longer, depending on sales. Remember, you only pay back when you sell to customers. Average repayment times are 4 months – 6 months as there are not a fixed repayment schedule.

You might look at these figures and think “I’ll be paying 10% interest”, but that’s not the case. With a merchant cash advance, repayments are taken from your revenue — so the 10% figure doesn’t refer to interest, but rather the proportion of your revenue that will go towards paying back £12,000.

The most important thing to understand it is done on a proportional basis. An advantage to this is repayments are mirrored in line with your sales, and the payback period is dependent on your sales cycle. The great benefit is that the total cost of finance doesn’t change. Meaning you will repay £12,000 without any compounding interest.

This method of repayment means that merchant cash advances are more flexible than bank loans, because instead of a fixed monthly repayment that has to be met regardless of your sales, the amount you repay goes up and down each month in line with your sales.

Business Cash Advance Advantages

Every venture needs capital from time to time but a bank loan isn’t always accessible. A Business Cash Advance offers a very different way of receiving a financial boost but without so many restrictions on the repayments. This type of additional funding allows a merchant cash advance company rights to claim a proportion of your future sales in return for advancing an agreed and set amount of cash upfront. Working close with your merchant gateway and card terminal provider, the business cash advance direct lender will receive an agreed proportion of future transactions until the cash advance is paid off.

This amount is set and agreed is usually round 10% per transaction, this is deducted from future card sales, and goes towards paying back the loan. Every time a sale is made and processed via your PDQ Card machine, if the sale has a value of £100.00, the revenue you will receive is £90.00. The remaining amount of £10.00 will then go to the merchant cash advanced lender to make repayment towards the advance.

The main advantage with this type of borrowing is that there is no credit checks, so this type of borrowing can be very quick to arrange. Most lenders can arrange for funding to be in place within 48 hours. The funds will arrive in your companies account soon after. Probably the best advantage is due to your sales determining the amount you can borrow there is no need to give personal guarantees or any other kind of security

Some of the features and benefits of a business cash advance.

Alternative business funding product

Advance amounts up to £200,000

Companies with bad credit welcome to apply

Fixed monthly payments and no APR

Security is not required

Credit and debit card sales used to raise funding

Application process is quick

Cash availible to draw down in days

Repayments are made via a small percentage of your monthly credit/debit card transactions

Ideal funding solution for small to medium-sized ventures

Approval rate for applications is about 90%

We offer an alternative cash flow finance to UK based businesses, this product is known as a business cash advanced. Our advance of future revenues allows access to funding of up to £200,000 with repayments that are manageable. We believe our service offers UK business an alternative to bank loans and is designed for small businesses without the need of a business plan.

Cash advance loan amounts are based on the amount of income you make from credit and debit cards and the repayments are linked to this amount as well.

Qualifying Criteria for a Merchant Loan Advance

Qualifying criteria for a merchant loan advance is far more relaxed than traditional finance. The exact eligibility requirements will vary between lenders but as a general rule of thumb for UK businesses, you need take use a card terminal to take payments and meet the following criteria to qualify for a merchant cash advance. The business should have a trading history of six months or more.

UK based company

Accept credit and debit card payments

A minimum of 6 months trading

A strong history of card payments with a minimum monthly turnover of £5,000 per month in sales revenue

Lenders may want to take a look at your credit history by way of a soft credit check, these are less intrusive compared to other types of borrowing and does not leave a footprint.

Frequently asked questions

The amount you can borrow is dependent upon your monthly card takings turnover, this is taken as an average over the last six months. The greater the sales turnover that goes through your card machine, the larger amount you can get advanced. If your business has a monthly average of £10,000 in sales via your PDQ Machine per month. The amount of funding you qualify for would be the same amount. Subject to underwriting the funding you could receive via a merchant cash advance could be up to 150% of your monthly card turnover meaning you could receive a larger sum. Credit levels that are available to your business via a lump sum are generally between £5,000 and £200,000. It has been known to support businesses with greater amounts.

Merchant cash advances are a short-term funding product meaning the term of the loan has a maximum of 18 months. The repayment time is dependent on your business performance from your credit card payments or debit card payments. This is great is sales are slow, meaning you pay back less, when sales are good the amount is paid back faster. Typical periods to make repayments are 6 to 8 months. As it is classed as flexible finance repayments can be as short as 4 months and stretch to a maximum of 18 months. Subject to affordability and the companies repayment history you will be offered an option to top-up your funding. This will allow you to increase the borrowing and extend the current term.

Your business needs to meet certain criteria to qualify for funding. It has to be a limited company, partnership or sole trader with a registered office based in Scotland, England and Wales. Customers must pay via a PDQ machine or online sales through an ecommerce merchant gateway provider. There is a number of industry types & trades that qualify for a business cash advance. The following examples is not a comprehensive list. Don’t panic if your business type is not shown: hospitality and retail, shops, restaurants, hotels, coffee shops, cafes, MOT service stations and garages. The all receive payments from their customers via card payments. Your business needs to have been trading for a period of six months and turning over at least £5,000 in card sales a month.

Costs of a merchant cash advance are based on our pricing structure, this is based on a number of factors, each business is unique and so are our quotations. Commercial finance is based on a straightforward calculation of a number of factors. The cost to your business is calculated on something that is called a factor rate, this gives you a total repayment figure. When you make a sale and your customer pays by card a percentage of that sale goes to make the repayment of the loan amount until it is paid off in full. It is one simple payment there are no other charges or costs associated with this type of borrowing. To establish a costing the lender gives you a factor rate based on your monthly card turnover . This will dictate the risk, and gives the percentage of each sale that is required to repay back to the lender.

The monthly repayments are not fixed! This is not classed the same was as a business loan, there is no APR or fixed term. As it is based on your card payments within your business, there is no set repayment term. A small repayment is taken on each transaction until the advance is repaid in full. This type of finance works well with businesses that have seasonally adjusted sales.

No soft credit checks are carried out during the application process. Once you have been approved for finance, lenders will make a hard credit search against your company, this is carried out by a credit reporting bureau. Warning late payment and missed payments may affect your credit score causing make money problems.

E commerce businesses work in the same way as if you are a bricks and mortar type of business who use standard PDQ merchant terminals. If your Ecommerce business uses an online payment processer such as Stripe, Worldpay Online, Shopify Payments, Paypal Online payments, SagePay, Amazon Pay, Payoneer, Klarna, Adyen, 2Checkout or any other online payment gateway, merchant cash advance lenders UK will be happy to work with you.

Factor rate’s are used by lenders to determine the total repayment value of the borrowing. A factor rate is a calculation whereby the amount of funding required is simply multiplied by the factor rate figure (The common percentage used is between 1.1 and 1.5).

Using the following example, let’s say your business borrows £5,000 based on your monthly sales volume, and a factor rate at 1.25 is set by the lender. This amounts to the following : cost of finance : £5,000 x 1.25 = £6250.

Lenders set the factor rate on a number of set performers such as your business trading performance, what is the escort you are training in and other risk elements associated with the business. Our expertise within the finance world allows us to ensure you get you get competitive factor rates, this allows you access to some of the best rates on the market.

The amount which you are required to pay back is set when you take out the cash advanced sum. The length of time that it takes you to repay off the total amount is depend on the value of the card transactions that you take from your customers. Our experience has shown many businesses find that once they have spent the business cash advance on the items or services they need to build their businesses, they have seen a sharp increase in the value of their sales. Due to the growth of their business and increased sales receipts it enables them to repay the outstanding amount they owe earlier than planned. Should you decide on a PDQ Funding advance, an application to refinance the original amount or more once 60% of the original advance has been settled.

Although fees can be slightly higher than traditional business finance from a bank, merchant cash advances can deliver a number of benefits for your business. This type of funding allows access to business finance in a shorter time than a high street bank, decision in principle for approval can be made in within just 24 hours.

Application processes are quick and simple with a minimal paperwork required. This is due to the lender requesting all the information requested from your merchant provider.

Merchant cash advances technically are not a loan, it is an advance based upon the future revenues of credit & debt card sales. In short you are selling future revenue to a lender, these are then purchased at a discount.

Rates on this type of lending are competitive, it also offers more flexibility compared to high street providers. Businesses must has a steady stream of credit card payments, monthly minimum of £5,000. SME owners considering this option should make sure he or she understands the terms being offered so they can make an informed decision about potential ROI.

A business cash advance is not currently authorised and regulated by the FCA (Financial Conduct Authority) in the UK. This allows the product to be fast & flexible. Lenders will offer funding products that, they will advise if the product is FCA regulated in the United Kingdom.

A merchant cash advance calculator allow you to calculate the merchant cash advance repayments based on your required loan amount, card turnover and your chosen factor rate, you can do this with our easy to use calculator.