The last few years have been tough for dental practices and groups. As a result of the COVID-19 pandemic, dental practices had to reduce their patient traffic to emergency only appointments from busy waiting rooms with steady streams of patients.

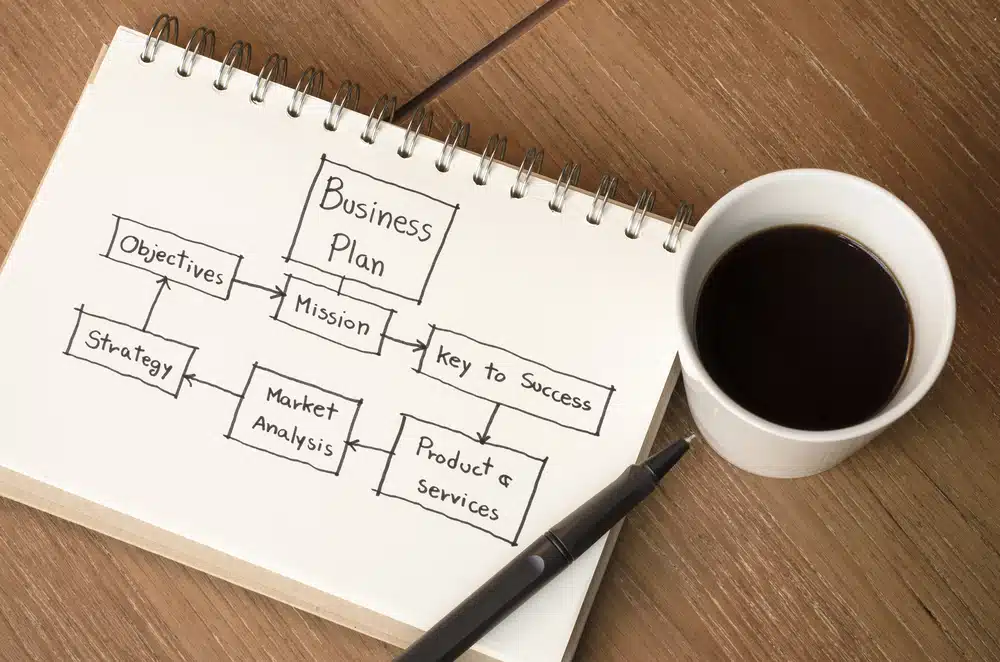

During the government-imposed lockdowns, many businesses struggled to make ends meet due to rent and expenses. It is now possible for those who have done a great deal of planning to recover more quickly. What are their methods for accomplishing this? Primarily by having a great business plan.

A plan is a good place to start when it comes to protecting your business from the unexpected impact of a global pandemic. It’s never too early to write a business plan for your dental practice, whether you’re starting a dental clinic from scratch or already have one. This process will help you to identify opportunities for growth even if you are not certain about the future of your business.

There will always be a need for dentists, even in turbulent times. Approximately two-thirds of dentists predict a decline in income over the next year, according to the General Dental Council (GDC). In other words, preparing a business plan will enhance your chances of securing finance or attracting the attention of industry leaders.

Interested in learning more about writing a dental practice business plan? Find out everything you need to know by reading through this article.

Why do I need a business plan for my dental practice?

You may be wondering whether it’s worth your effort to write a business plan for a dental practice, but we touched on its importance in the introduction. It may seem as if you don’t have time to create a business plan from scratch, especially if your business is going well. However, a strong business plan can help you identify risk factors and open up new opportunities, even if you are already satisfied with how the business is going.

Investors and lenders will be able to tell if you have put thought into where you hope your business will go if you write a comprehensive business plan. In order to identify areas of risk as well as strengths in your business operation, lenders will be keen on seeing a business plan when seeking finance for a new practice or switching finance products.

If your business is a dental partnership or you are the sole shareholder, your business plan outlines how your operation will operate. You will also stand out to your lenders if you have already recruited, or plan to recruit, associates and demonstrate your investment in the business.

Any growing dental business must have a comprehensive business plan in order to succeed.

What is a dental practice business plan?

As a dentist starting a new practice, a business plan is essential to define the vision and goals of the practice, and how to achieve them. A business plan can help you identify the unique value proposition that your practice will offer, the target market and competition, financial projections, and a clear plan for executing your vision. It is also an opportunity to analyze potential risks and develop strategies to mitigate them.

By having a well-crafted business plan, you will be able to make informed decisions about the various aspects of your practice, such as location, staffing, marketing, and equipment purchases. Overall, a business plan can help you establish a solid foundation for your dental practice and increase the likelihood of success.

Having a comprehensive business plan is essential to running a successful business. The business owner writes a business plan in conjunction with their associates and any external consultants to cover everything from operational structure to financial planning to recruitment and marketing strategies. If you’re a dental professional, you may need to work with a business expert and specialist dental accountant to develop a plan suited to your needs.

An outline of the current business situation and where it hopes to go is the purpose of a business plan. Do not worry if you haven’t updated your business plan for a few years or if you haven’t run your business without one.

You can take a step back from the day-to-day operations of your dental practice by writing and maintaining a business plan – a key challenge for dental professionals who see patients as well as run their business – and gain the knowledge you need to make informed decisions about your practice’s future.

What should I include in my business plan?

The next step is to learn how a business plan is written. You now know what a business plan is and why you need one.

Executive summary

An executive summary is an essential part of any well-structured business plan. Due to the length and detail of a business plan, the executive summary gives readers an overview of the main points. An executive summary should include information about your business structure, your financial situation, and your future plans, for instance.

What is the best way to write an executive summary? It is possible that you have written one before, or that you have a business consultant to assist you in the process. However, if this is your first time then this is what we recommend:

- You will be in a better position to identify and summarise the key points once you’ve completed the document, and writing it last will save you from going over it a few times. Even if you wrote the executive summary after completing the other pages, it should appear at the beginning of the document.

- Your executive summary should not exceed two pages. A business professional may recommend a single-page summary, but if that’s too restricting for you, keep your plan under two pages.

- Consider the reader: Think about who will be reading the executive summary. Investors and lenders often read this section to gain a better understanding of your business, so ask yourself: what matters to them? You can highlight key facts and figures in the executive summary, such as an increase in appointments, an investment in new dental equipment, or the recruitment of a new associate, for example.

- Executive summaries are just that… summaries, as the name suggests. Your summary should include the highlights from each section.

Always keep in mind why an executive summary is important when writing one. You should always include any important information in the executive summary that could work in your favour when pitching to investors and lenders.

Adapt your executive summary if you are preparing an application for finance to highlight your lender’s key concerns and risk factors.

Business structure

An overview of your business, including information about any partners or associates, should be included in the first section of your business plan. Consider including your past relevant roles if you are the principal dentist. It is especially important for lenders to know about your business partners if it is a partnership.

According to the General Dental Council, a dental partnership can only exist between two dental professionals. Check out our definitive guide to starting a dental partnership if you’re just starting out and aren’t sure whether you qualify for a partnership, or if you should structure your business differently.

Organisation and operations

According to your business structure, here is where you can describe your operational plan. Do you operate seven days a week and where is your office located? What are your hours of operation? Are you a private clinic, NHS clinic, or a combination of both? Is there an out-of-hours service available? You can highlight any specialties, such as cosmetic dentistry, that may interest potential investors or partners along with answers to all of these questions.

Assets, such as property and equipment, should also be included in the operations section. Considering how important equipment is to the operations of a dental practice, we recommend dedicating a subsection to it. Record the purchase or rental of all new equipment, as well as when it needs to be serviced.

Financial plan

An important part of your business plan is your financial situation. We will explore every aspect of your financial situation here, including whether you have made an initial investment, what you plan to invest in the future and what type of financing you have received or will seek.

Your previous year’s financial statements, as well as any key areas of growth, can be included in this document if your dental practice has already been established. In addition, details of your income and outgoings are important if this business plan is intended for a new practice.

In contrast to NHS practices, private practices must provide information regarding the cost of dental services in their financial reports. Here, you will be able to compare your prices to market averages and determine if you need to increase them periodically.

When preparing this section of your business plan, you should always consult a specialist dental accountant. It is not uncommon for dental professionals to be in the same position as others during this difficult economic time, considering refinancing their dental practices to consolidate debt or transferring to a new finance product that offers better terms.

Accounting firms that specialise in the medical sector can also be helpful, but why use general accountants when you can use specialists who understand everything from your practice’s cash flow to capitation schemes?

Sales and marketing strategies

Marketing and sales often work together to achieve common goals, but each requires its own strategy.

Reaching and communicating with your target audience is a key part of a good marketing strategy. Local communities are likely to be affected in your case. All these strategies will help spread the word about your practice, boost your online presence, and, ultimately, get you new patients through the door. In many cases, dental professionals will outsource their marketing support because it is often neglected in favour of more pressing matters.

You may want to consider seeking investment, finance, or investment-related support, so you can both hire an expert as well as invest in proven methods like Google and Facebook advertising.

It’s more important to generate the necessary leads when it comes to sales strategy to ensure a consistent flow of appointments. Private practices, especially those that provide specialist dental care, should pay special attention to this. Partner and associates should be informed of the pricing structure and be given the tools to determine whether upselling is appropriate.

You should often go for a soft-sell approach instead of making your patient feel pressured to purchase your service, since sales in the dental industry heavily rely on trust. Working with experts in your field and feeling confident in your messaging are important elements of any healthcare business. Your business plan should include all of this, as well as any plans for future growth.

Read more: Problems of selling a dental practice to an associate

The importance of a business plan for dental practice finance

For securing finance, it is important to have a comprehensive business plan. Not all practices will be offered the same terms when applying for dental practice finance, and not all practices will be able to ask for funds for a project or to cover a difficult time. Business plans that demonstrate you fully understand your current situation and demonstrate you’re prepared for the upcoming financial period will work in your favour.

The business plan can also be used to reframe your practice as a business rather than a continuation of your career – justifying future expansion, new employees, and premises expansions or equipment upgrades.

Funding for all these goals is only available to businesses with sound business plans, which reinforces the importance of completing one no matter what stage you are at. To get the most lucrative sale for your dental practice, sometimes a business plan is still important to encourage additional investment to upgrade equipment to appeal to certain buyers.

Conclusion

A business plan is essential for anyone starting a dental practice as it provides a comprehensive roadmap for the business. A well-crafted business plan can help dentists identify their target market, assess the competition, and develop a sound financial strategy. It also provides a framework for making critical decisions, such as choosing a location, purchasing equipment, and hiring staff.

By creating a business plan, dentists can clearly outline their goals, determine the resources needed to achieve them, and set a timeline for meeting their objectives. Ultimately, a business plan can help dentists make informed decisions and increase their chances of success when launching a new dental practice.

Lee Jones is a seasoned Business Finance Specialist with over two decades of invaluable experience in the financial sector. With a keen eye for market trends and a passion for helping businesses thrive, Lee has become a trusted advisor to countless organizations seeking to navigate the complexities of finance.